One Of The Best Tips About How To Lower Property Taxes In Ohio

Plus, since there are several ways your appeal can get thrown out (and lots of heady math involved), a tax attorney can help you figure out whether you have a case—and help.

How to lower property taxes in ohio. What can you do to lower your property tax in ohio? How to lower your property taxes in ohio, when the value of your home decreases first, review your property records with the county auditor’s office. First, if the owner is seeking a decrease in property value of more than $50,000, the bor will notify the local school district.

How can i lower my property taxes in ohio? First, if the owner is seeking a decrease in property value of more than $50,000, the bor will notify the local school district. If you want to reduce your property tax liability in ohio, you have to address either the tax rate or the assessed property value of your.

In 2005, as part of a broader series of tax reforms, the general. Appraised values should equal 100% of market value. How to get a property tax reduction in ohio if you need help paying property taxes, there are a couple of strategies for reducing taxes that might work:

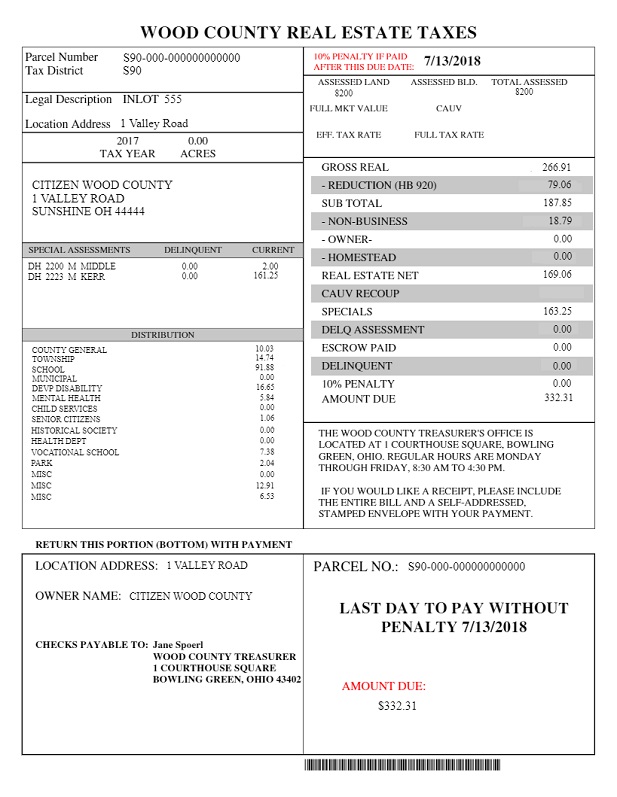

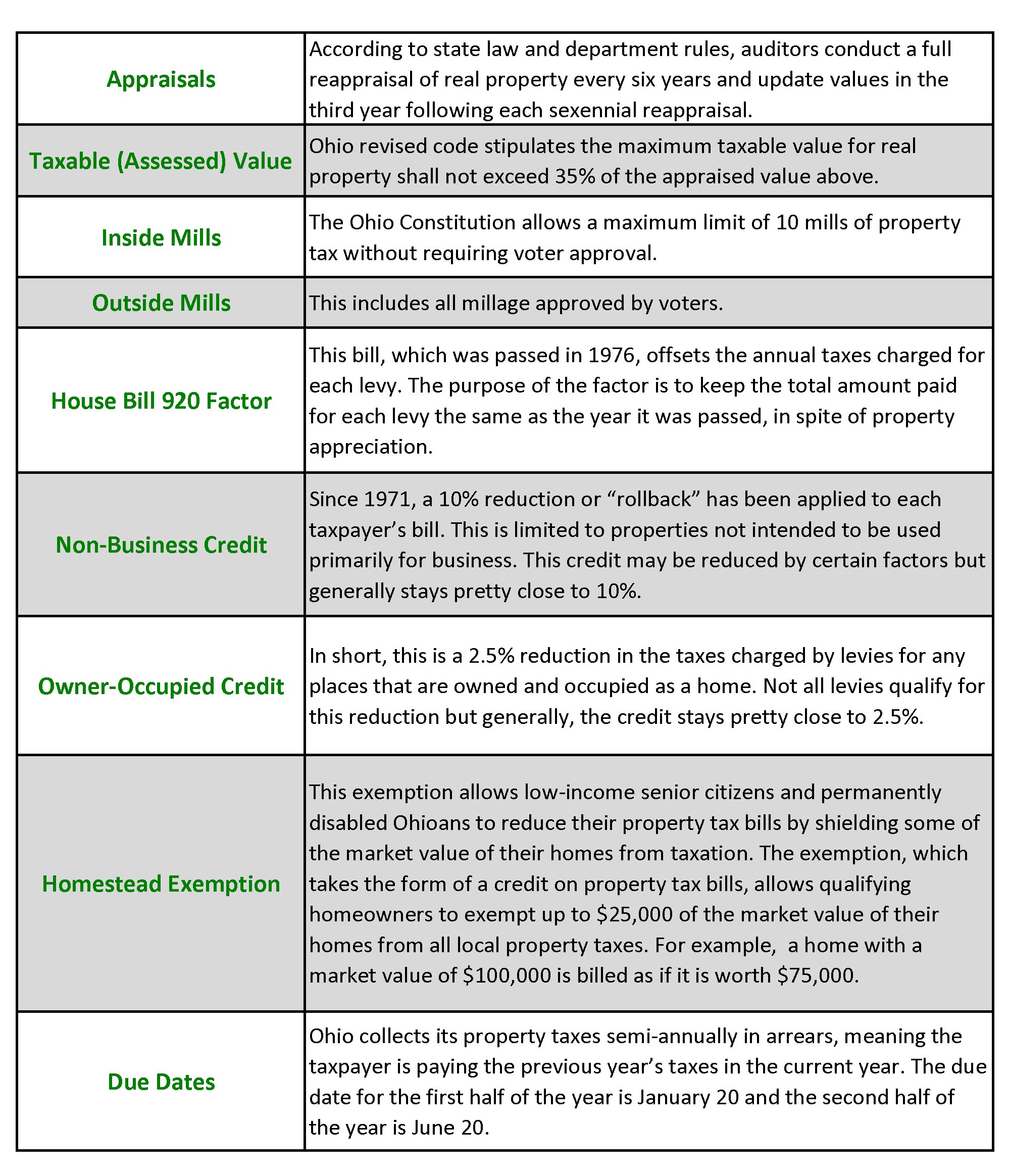

Find all tax breaks to which you're entitled. The tax is determined by applying the effective tax rate to the assessed value and applying a 10 percent rollback. School districts generally receive between 65 percent.

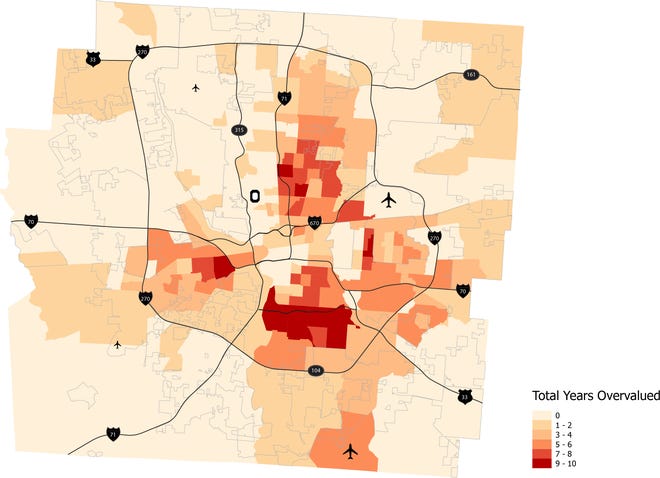

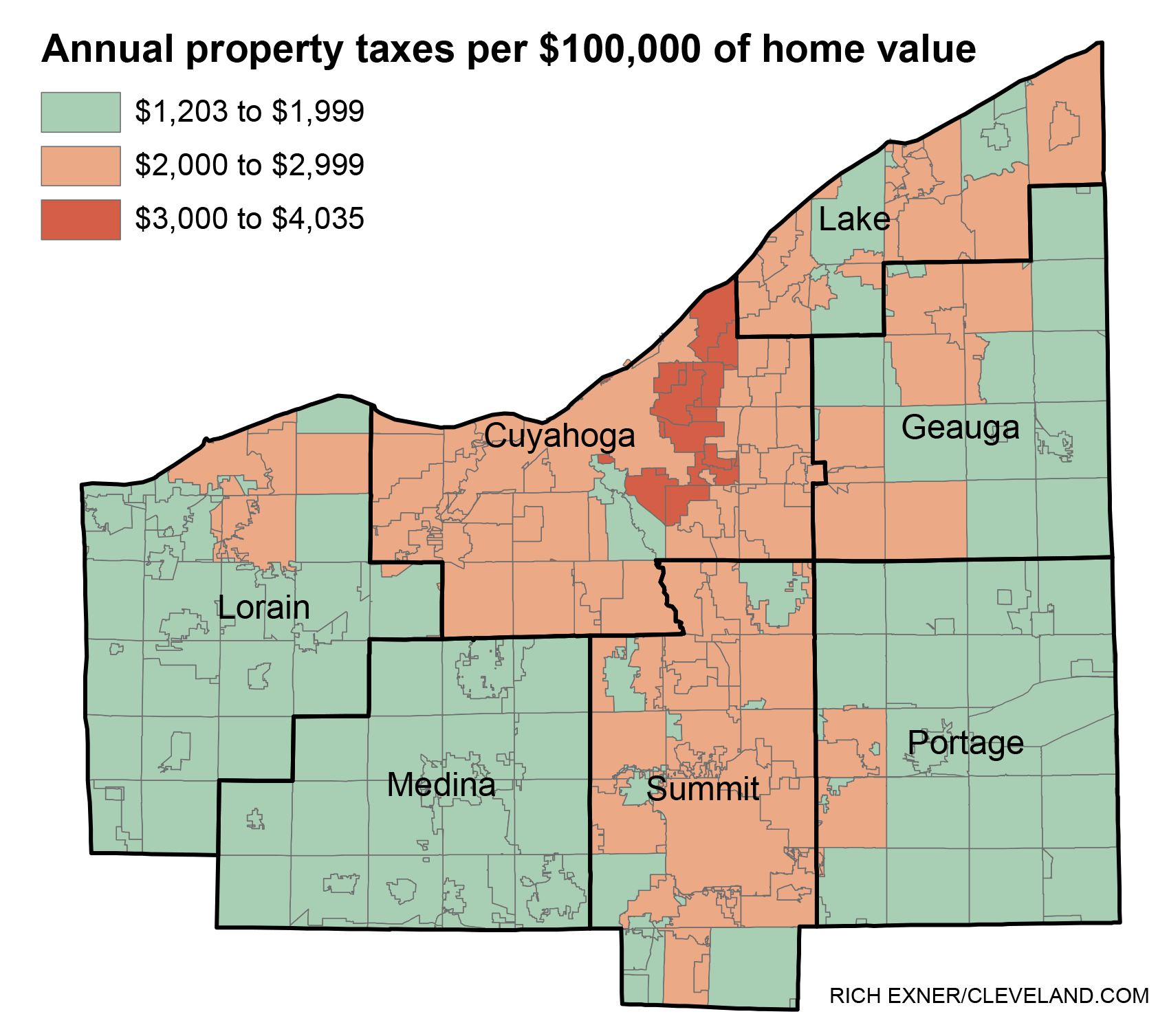

Don't build or make changes to your curbside just before an assessment as these steps may increase your value. The ohio department of taxation maintains detailed statistics on property values and tax rates at the county, city and school district level. The homestead exemption allows low.

Up to 25% cash back fortunately, there are two possible ways to reduce your property tax burden. In order to lower your current property tax, first evaluate your current property record card. this is the official description of your house. Ask for the property tax card—request.

How to lower property taxes in ohio. If you need to pay in person, the columbus county courthouse at 365 south high street, columbus, ohio 43215, has an accessible drop box for paying taxes by mail. The exemption, which takes the form of a credit on property tax bills, allows qualifying homeowners to exempt up to $25,000 of the market value of their homes from all local.

School districts generally receive between 65 percent to 70. In order to lower your current property tax first evaluate your current property record card this is the official description of your house. Those values, multiplied by local tax rates, result in the.

Since 1971, a 10 percent reduction, or “rollback,” has ap plied to each taxpayer’s real property tax bill. The department's tax equalization division helps ensure uniformity and. The first method is available to all ohio homeowners.

You can find this on the hamilton. Counties in ohio collect an average of 1.36% of a property's assesed fair market. How property values are determined.